[ad_1]

Knowledge collected by ET revealed that banks have elevated spending thresholds and caps, indicating a give attention to profitability within the mortgage phase, which has been rising alongside rising affluence in city India.

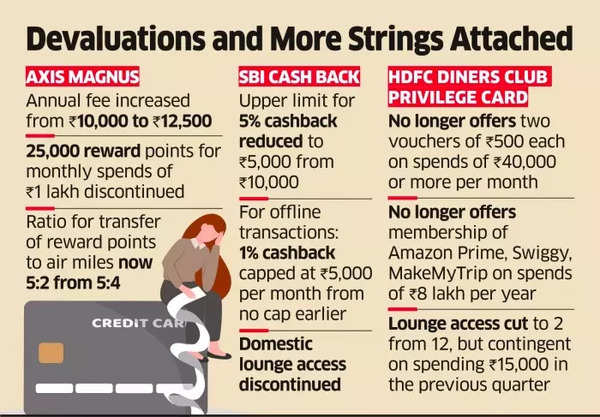

For instance, HDFC Diners Membership Privilege Card has discontinued its double reward factors on weekend eating, Rs 1,000 vouchers on month-to-month spends of Rs 40,000, and diminished international lounge entry from twelve to 2. SBI Money Again Card has halved the month-to-month cashback quantity to Rs 5,000 and discontinued home lounge entry. SBI Card didn’t reply to an e-mail in search of remark.

Bank card perks take a success

Axis Financial institution’s Magnus card has raised its annual charge and discontinued the provide of 25,000 reward factors on spends of Rs 1 lakh. The conversion of reward factors into air miles has additionally been restricted to 2 air miles for each 5 reward factors, in comparison with the earlier provide of 4 air miles.

Analysts recommend that this transfer by banks to devalue bank cards signifies their want to tighten their belts. Karhtik Srinivasan, Group Head of Monetary Sector Scores at ICRA, acknowledged, “They’ve constructed a buyer base most likely with provides that had been too good, however now there’s some stress on banks’ profitability.” Nevertheless, there was no vital impression on card issuances or spending to date, he famous.

Bankers have acknowledged that these modifications will improve profitability for the enterprise and handle anomalies. Sanjeev Moghe, Head of Playing cards & Funds at Axis Financial institution, defined, “There have been modifications as a result of we felt that some clients weren’t utilizing the advantages absolutely and others had been displaying some irregular behaviour in spending.”

HDFC Financial institution CFO SK Vaidyanathan famous that the modifications purpose to extend card utilization and foster buyer loyalty. HDFC Financial institution, the nation’s solely lender with a market worth exceeding $100 billion, leads the phase, accounting for over 1 / 4 of card spends.

Asutosh Mishra, Head of Institutional Equities at Ashika Inventory Broking, emphasised that these modifications mirror the altering market situations influenced by rising inflation and costs, which impression the worth of reward factors supplied by banks.

[ad_2]