[ad_1]

Customers confirmed sudden power in November, giving a stable begin to the vacation season as inflation confirmed indicators of continued easing.

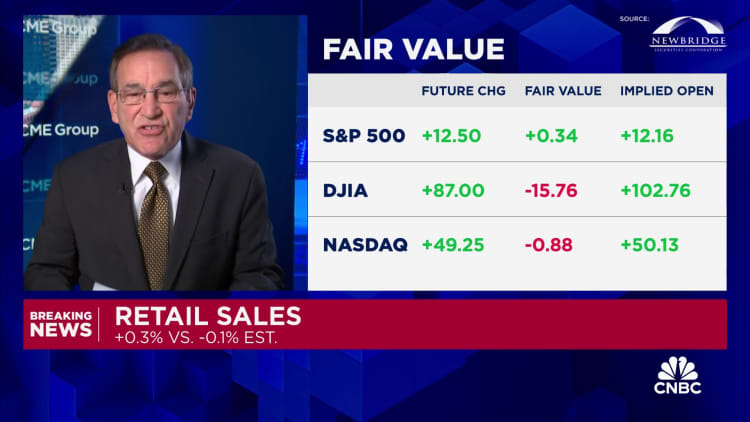

Retail gross sales rose 0.3% in November, stronger than the 0.2% decline in October and higher than the Dow Jones estimate for a lower of 0.1%, the Commerce Division reported Thursday. The full is adjusted for seasonal elements however not inflation.

Excluding autos, gross sales rose 0.2%, additionally higher than the forecast for no change. Stripping out autos and fuel, gross sales rose 0.6%.

With the patron worth index up 0.1% on a month-to-month foundation in November, the retail gross sales quantity exhibits customers greater than maintaining with the tempo of worth will increase.

On a year-over-year foundation, gross sales accelerated 4.1%, in contrast with a headline CPI price of three.1%. The inflation price continues to be above the Federal Reserve’s 2% goal however is effectively beneath its peak above 9% in mid-2022.

“The rebound in retail gross sales in November supplies additional illustration that the continued speedy decline in inflation shouldn’t be coming at the price of considerably weaker financial progress,” stated Andrew Hunter, deputy chief U.S. economist at Capital Economics.

Gross sales held up regardless of a 2.9% slide in receipts at fuel stations, as power costs broadly slumped through the month. Gasoline station gross sales had been off 9.4% on a 12-month foundation.

That weak point was offset by a rise of 1.6% at bars and eating places, a 1.3% acquire at sporting items, interest, guide and music shops, and a 1% enhance at on-line retailers.

The so-called management group of gross sales, which excludes auto sellers, constructing supplies retailers, fuel stations, workplace provide shops, cellular houses and tobacco shops and feeds into calculations for gross home product, elevated 0.4%.

In different financial information Thursday, the tempo of layoffs slowed sharply final week.

Preliminary claims for unemployment insurance coverage totaled a seasonally adjusted 202,000 for the week ended Dec. 9, a decline of 19,000 from the earlier week and the bottom complete since mid-October, in response to the Labor Division. Economists had been in search of 220,000.

Each stories come the day after the Federal Reserve indicated that sufficient progress has been made within the inflation battle to begin decreasing rates of interest subsequent 12 months. In response to projections following the coverage assembly of the Federal Open Market Committee, central financial institution officers anticipate to chop about 0.75 share level off short-term borrowing charges in 2024.

Although Fed officers anticipate financial progress to sluggish significantly within the 12 months forward, they don’t foresee a recession.

Do not miss these tales from CNBC PRO: